Investing in vacation rentals can be an appealing opportunity for many. If managed properly, they can generate significant passive income and appreciate over time. The key lies in understanding your market, choosing the right location, and effectively managing the property to maximize returns.

As travel continues to grow, the demand for short-term rental properties remains strong. You’ll need to evaluate potential rental income against expenses and market trends to determine if it aligns with your financial goals. Engaging with effective marketing strategies and customer service can further enhance your investment’s success.

The landscape of vacation rentals is constantly evolving, shaped by changes in travel habits and technology. It is essential to stay informed about regulations and market dynamics to ensure that your investment remains profitable and sustainable.

Table of contents

Understanding Vacation Rentals as Investments

Investing in vacation rentals has become increasingly popular. You must consider profitability, market dynamics, and how they compare to traditional rental properties when evaluating this investment type.

Profitability Potential

Vacation rentals can offer lucrative returns. Many investors see higher average daily rates (ADR) compared to long-term rentals. For example, a vacation rental in a prime tourist area might charge $200 per night, versus a traditional rental at $1,200 per month, resulting in:

- Higher income potential: 15 nights booked at $200 generates $3,000 monthly.

- Seasonal peaks: Occupancy rates often spike during holidays or local events.

However, be mindful of expenses like maintenance, management fees, and utilities, which can reduce profit margins. You should also factor in the costs of property furnishing and marketing to attract guests.

Market Trends and Demand Analysis

Understanding current market trends is essential. Analyze tourist patterns, seasonal demands, and local regulations affecting short-term rentals. Key factors include:

- Location: Proximity to attractions can increase occupancy rates.

- Online platforms: Sites like Airbnb have changed how travelers book stays, creating wider exposure.

It’s advisable to research your target market. Tools such as Google Trends or Airbnb data can provide insights on demand fluctuations. Staying updated with local laws regarding rentals can prevent legal complications and enhance profitability.

Comparing with Traditional Rental Properties

When comparing vacation rentals to traditional rentals, several key aspects emerge. Consider:

- Tenant turnover: Vacation rentals have higher turnover, leading to varied management efforts.

- Rental terms: Shorter rental periods offer flexibility but require consistent marketing.

Traditional rentals provide more stable income with longer leases, but they may not yield the high returns seen in vacation rentals. You need to assess your commitment level and willingness to manage frequent bookings versus stable, consistent tenants.

Evaluating Locations and Properties

Choosing the right location and property features is critical for the success of a vacation rental investment. You must focus on areas with high demand and properties that offer desirable amenities while also considering local regulations.

Identifying High-Demand Areas

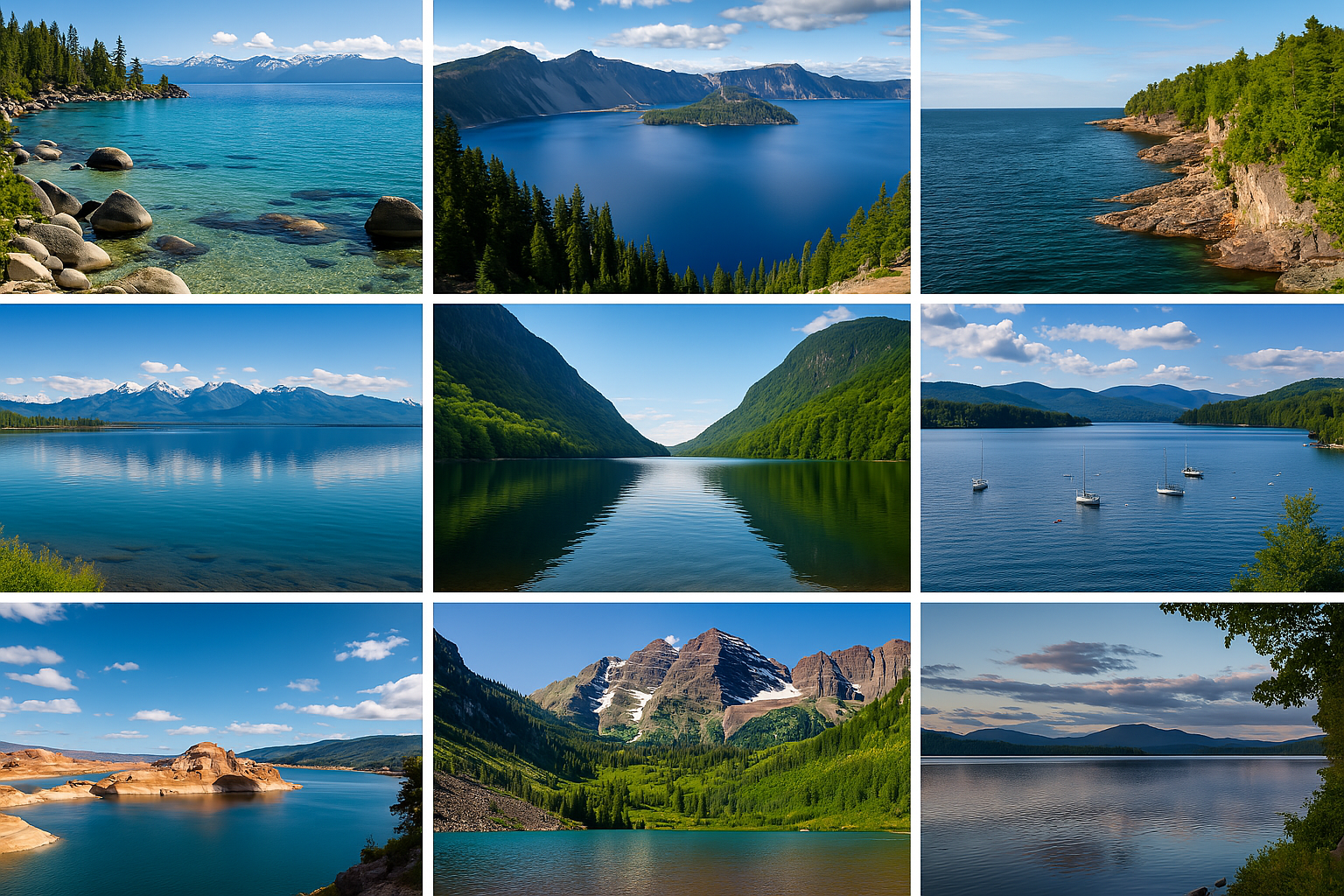

Start by researching popular tourist destinations and seasonal hotspots. Look for locations with:

- Attractions: Nearby beaches, national parks, and entertainment venues draw visitors.

- Accessibility: Proximity to airports and public transportation can enhance appeal.

- Market Trends: Analyze rental data to identify areas with increasing occupancy rates.

Use online tools like AirDNA or Zillow to assess demand and pricing trends. Additionally, consider local events and festivals that may attract visitors throughout the year.

Assessing Property Features and Amenities

The features and amenities of a property can significantly impact its attractiveness. Consider the following:

- Space: Properties with multiple bedrooms and bathrooms cater to larger groups, increasing rental potential.

- Unique Selling Points: Features like hot tubs, pools, or scenic views can justify higher rental rates.

- Modern Upgrades: Well-maintained and modernized properties attract more bookings.

Evaluate the competition by comparing similar listings. Look for standout attributes that set your property apart, helping you to attract diverse guests.

Local Regulations and Zoning

Understanding local laws is essential to navigate potential restrictions. Research:

- Short-Term Rental Laws: Different municipalities have varying regulations regarding vacation rentals. Check for licensing requirements or limitations on rental duration.

- Zoning Regulations: Some areas may have zoning laws that affect the legality of operating a rental property.

- Tax Obligations: Be aware of any taxes or fees associated with short-term rentals, including occupancy taxes.

Engaging with a local real estate professional can provide insights into navigating these regulations effectively.

Costs and Financial Considerations

When considering vacation rentals as an investment, understanding the financial implications is crucial. This includes your initial investment, ongoing operating expenses, tax ramifications, and potential revenue. Each aspect can significantly impact your overall returns.

Initial Investment and Financing Options

The initial investment for a vacation rental includes the purchase price, closing costs, and possibly renovation expenses. Prices vary widely depending on location and property type. You can finance your purchase through conventional loans, private mortgages, or cash.

Before deciding on financing, assess your budget and financial capabilities. Some lenders offer special terms for investment properties, which can influence your decision. An important consideration is your down payment, typically ranging from 20% to 30% for investment properties. Understanding these factors helps you gauge your entry cost effectively.

Operating Expenses and Tax Implications

Owning a vacation rental involves various operating expenses. Common costs include property management fees, utilities, maintenance, insurance, and property taxes. You may also need to consider marketing costs to attract guests.

Additionally, familiarize yourself with tax implications. Rental income is generally taxable, but you can deduct many expenses related to property management, repairs, and depreciation. Tracking these expenses meticulously can help maximize your tax savings.

Revenue Projections and ROI Estimations

Estimating your potential revenue is key to understanding your investment’s viability. Research local rental market rates to gauge what comparable properties earn. Factors affecting income include location, seasonality, and property type.

Calculate your return on investment (ROI) by comparing net income against total costs, including your purchase price and ongoing expenses. A typical goal is an ROI of 8% to 12%, but local market conditions can influence these figures. Understanding expected revenue helps you make informed decisions about your purchase.

Also read on : Finding Monthly Vacation Rentals

Management Strategies for Vacation Rentals

Effective management is crucial for maximizing the profitability of your vacation rental. It involves decision-making regarding management style, marketing efforts, and property maintenance.

Self-Management vs. Professional Property Managers

Choosing between self-management and hiring professional property managers is a pivotal decision.

- Self-Management

- Cost-effective, as you avoid management fees.

- You have direct control over pricing, guest interactions, and maintenance.

- Time-consuming, requiring consistent attention to detail for bookings, cleaning, and guest communication.

- Professional Property Managers

- Charge fees typically ranging from 10% to 25% of rental income.

- Bring expertise in marketing, pricing strategies, and hassle-free guest management.

- Allow you to focus on other priorities while ensuring the property is well-maintained and guest needs are met.

Marketing and Guest Relations

Effective marketing and excellent guest relations can differentiate your vacation rental from competitors.

- Marketing Strategies

- Use high-quality photographs and professional descriptions on listing platforms.

- Leverage social media and local tourism websites for exposure.

- Optimize pricing based on market trends and competitor analysis.

- Guest Relations

- Respond promptly to inquiries; timely communication can enhance bookings.

- Provide a personalized experience, from welcome notes to local recommendations.

- Encourage reviews post-stay, as positive feedback increases future bookings.

Maintenance and Upkeep

Regular maintenance keeps your property appealing and functional, impacting guest satisfaction.

- Preventive Maintenance

- Schedule routine inspections of plumbing, electrical systems, and appliances.

- Keep outdoor areas well-maintained for curb appeal.

- Responsive Repairs

- Address issues immediately to prevent negative guest experiences.

- Maintain a list of trusted local contractors for quick repairs.

- Cleanliness Standards

- Ensure thorough cleaning between guest stays to uphold hygiene standards.

- Consider hiring professional cleaning services for efficiency.

Implementing these management strategies can enhance your vacation rental’s performance and ensure a positive experience for your guests.

Risks and Challenges

Investing in vacation rentals presents certain risks and challenges that you should consider. Understanding these can help you make informed decisions and better prepare for potential setbacks.

Occupancy Variability and Seasonal Fluctuations

One significant challenge is the variability in occupancy rates. In many markets, vacation rentals can experience seasonal fluctuations where demand peaks during holidays or summer months and drops during off-peak seasons.

For example, if you invest in a winter ski resort, your rental might be fully booked in December, but experience low occupancy in April. This can lead to inconsistent income streams.

To mitigate this risk, consider diversifying your rental portfolio across different locations or types of properties to attract guests year-round. Additionally, using dynamic pricing strategies can help maximize your rental income during peak seasons while still attracting guests in off-peak periods.

Dealing with Damages and Compliance Issues

Another challenge involves potential damages to your property and navigating compliance with local regulations. Vacation rentals are susceptible to wear and tear from frequent use, and you may encounter unanticipated costs for repairs.

Moreover, various jurisdictions have specific laws regarding short-term rentals, including licensing, safety standards, and zoning regulations. Not adhering to these can lead to fines or even legal action.

To address these challenges, it’s crucial to conduct regular inspections of your property and maintain clear communication with guests. Additionally, familiarize yourself with local regulations to ensure compliance and avoid future complications. Implementing a solid rental agreement can also protect you from liabilities and clearly outline expectations for your guests.

Conclusion

Investing in vacation rentals offers promising returns, but it requires careful analysis, a strategic approach, and effective management. By considering market trends, understanding the financial implications, and staying updated on regulations, you can maximize your returns and minimize potential risks. Whether you are just starting or looking to expand your portfolio, Brownstone Vacations offers a wealth of information and resources to help you make informed decisions and find profitable rental opportunities.

For those looking to explore potential vacation rental options, check out vacation rentals in Washington State to start your investment journey today!